|

Photos

Resources

Respond to this story

|

Minneapolis Fed forecasts modest economic expansion

December 11, 2002

|

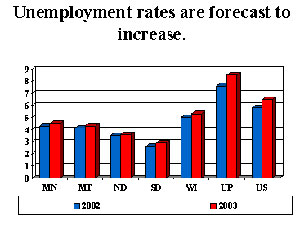

| Minnesota betters the U.S. only in unemployment, but the projected rate of 4.5 percent is well above the 3.9 percent that the state recorded in October. (Source: Minneapolis Federal Reserve) |

Minneapolis, Minn. — The Minneapolis Fed's statistical analysis indicates Minnesota will lag the U.S. in several important categories. Non-farm payrolls are projected to shrink three-tenths of a percent versus a slight expansion nationwide.

Personal income is forecast to grow at a little more than half the U.S. rate. Housing starts at less than half the U.S. rate. Minnesota betters the U.S. only in unemployment, but the projected rate of 4.5 percent is well above the 3.9 percent that the state recorded in October.

However, Minneapolis Fed Director of Research Art Rolnick says Minnesota may fare better than the statistic analysis predicts.

"I'm somewhat more bullish on Minnesota's economy than our model," he says.

Rolnick says past economic recoveries suggest that a rebound in job growth may be coming. The U.S. has posted four consecutive quarters of economic growth. Rolnick projects at least some job growth in Minnesota by the second half of next year.

"History tells us that recoveries begin with firms using their existing employees and capital more efficiently so we get some productivity gains, which we've had huge productivity gains, and then eventually they get confident that the economy will continue to do well and they start hiring back workers. What's a little bit difficult to know is the timing of that. But right now this has been a fairly long period of time without much job growth," according to Rolnick.

Rolnick also points to the survey of business leaders in the ninth district. Half of the respondents are in Minnesota. The distict also includes the Dakotas, Montana, Northwestern Wisconsin and Michigan's Upper Peninsula.

Nearly half the respondents predict rising sales, one quarter plan to invest more in their business, and one fifth expect to hire more full time employees. More than half are at least somewhat optimistic about their community's economic outlook.

"That was probably the biggest surprise; that their attitudes are picking up a little bit, that they're getting a little bit more optimistic. Maybe it's a good sign and a credible sign that businesses are getting a little bit more optimistic now, realizing that this could be sustained and we'll start spending more and hiring some more workers," says Rolnick.

Rolnick says whenever business investment picks up, hiring is likely to follow. But the survey also indicates business leaders see continued effects from corporate accounting scandals, and are concerned about a war in Iraq.

"Business leaders expect -- pretty overwhelmingly -- (that) war in 2003 would have a negative affect on their businesses," according to Minneapolis Fed regional economist Toby Madden. "Fifty-nine percent said it'd either have a somewhat negative effect or a very negative effect. But there's also 10 percent that said it would have a positive effect."

Thirteen percent of manufacturers said war would help their business at least somewhat. Madden says more than 80 percent of the respondents said public confidence issues including corporate accounting scandals, the war on terrorism and stock market volatility would hurt their businesses next year. He cites one comment from a respondent in Michigan's Upper Peninsula.

"You cannont trust the word of anyone in business today. That makes it hard to want to expand a business. It's a sad situation," he says.

For the U.S. next year, the Minneapolis Fed's statistical analysis projects stagnant job growth, rising unemployment and slower economic growth -- 2.1 percent compared to an expected 3.1 percent this year. That's a gloomier view than other forecasts of accelerating growth. But research director Rolnick rejects any contention the Minneapolis Fed's forecast is pessimistic. He says it's consistent with the economy's long term trend of 2- to 3-percent annual growth. He says the ninth district economy will fare about as well as the U.S. overall, but Minnesota retains an edge -- a highly educated work force.

"It has paid off before. I think it's going to pay off even more; the demand for educated workers continues to rise, the premium that the market's willing to pay for educated workers continues to grow. So I actually think the Minnesota economy will do a little bit better and that will help the region as a whole," Rolnick says.

|

News Headlines

|

Related Subjects

|