Audio

Photos

Your Voice

| ||||||||||||||||||||||||||||||||||||||||||||||||||

Taxes and prosperity: Where does Minnesota fit in a regional economy?

March 31, 2003

|

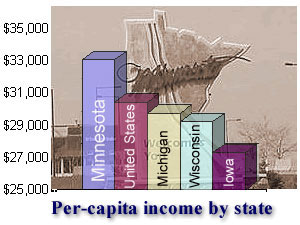

| Minnesota's personal income per capita tops the U.S. average, Wisconsin, Michigan, and Iowa. (MPR Graphic/Bob Collins) |

St. Paul, Minn. — The Pawlenty administration says Minnesota spends more per capita on state and local government services than Wisconsin, Michigan, Iowa, and the U.S. average.

The governor says Minnesota is spending too much, hemorrhaging jobs, and losing businesses to its neighbors.

| |||

"We’ve got to get serious about having an environment here that says to job growers and job providers, this is a place where it's a reasonable business decision to expand and grow your business here. And setting aside China and Mexico and Indonesia and the other places, I don't want to lose any more jobs to Wisconsin, and northern Iowa, and South Dakota, and North Dakota," says Pawlenty. In the last year, Ford Motor Co., picked Wisconsin over Minnesota for a new parts distribution center. Smaller firms have moved there as well, in some cases attracted by lower property taxes. The head of one small firm says the move saved his company nearly $80,000 in taxes. Others say it's a wash.

At Poly-Cam in Blaine, the company's 11 employees produce metal fittings for connecting pipes made of polyethylene plastic. Poly-Cam's president, Kathy Charlson, says a few years ago, lower business property taxes in Wisconsin got her attention.

"It was compelling enough for us to go over and seek a place in Wisconsin -- Roberts, Wisc. We purchased three acres of land, and they gifted us 2.5 acres of land. That would have provided enough expansion for us to hold us for the next 10 years we felt," says Charlson.

|

In the big picture, just because we're a high tax state, does not mean that our economy is suffering.

- Economist Art Rolnick, director of research, Federal Reserve Bank of Minneapolis |

But Charlson did not like the plans for neighboring properties, and worried about losing workers. She decided to stay in Blaine. She says she'd love to pay less in taxes, but even so, sales and profits are growing at double-digit rates.

"I think that it was good to stay here, right where we are, expand our facility. The company was profitable, it was doing well, and it was a doable thing to stay here in Minnesota also," says Charlson. Asked if Minnesota’s higher taxes are holding back her company, she says, "No. Not at all."

Many firms say taxes are a serious competitive disadvantage.

But Like Poly-Cam, Minnesota has prospered despite high taxes. From the end of the previous recession in 1991 through last January, Minnesota has created jobs at a higher rate than Wisconsin, Iowa, Michigan, North Dakota, and the U.S. as a whole.

Minnesota lags South Dakota's growth rate, but over the same period Minnesota's economy created nearly 160,000 more jobs than the Dakotas and Iowa combined.

| |||

In 2001, the most recent figures available, personal income reached $33,101 per Minnesotan. That tops all the border states, Michigan, and the U.S. average.

Economist Art Rolnick, director of research at the Federal Reserve Bank of Minneapolis, says personal income is a key measure of a state's economic success.

"We look at per capita income as probably the measure of how successful our economy is," says Rolnick.

Minnesota's personal income has been higher than the border states and the national average since 1981, and in the top ten since 1996. Wisconsin has lagged the national average for more than two decades.

| |||

Rolnick argues for keeping taxes on business as low as possible, but he says, "we've seen this economic growth despite these high taxes, which tells you we're getting something for our money; which tells you that the educational services, the public goods that we're getting, the clean air, the roads, the bridges, etc., are very important to economic growth, and we've enjoyed these public services, and it's one reason our economy is as strong as it is."

Both Rolnick and state economist Tom Stinson say Minnesota's strength stems from a highly educated and productive workforce. Stinson says the state has reaped benefits from not only its strong commitment to education, but also its neighbors' education investments.

"We have drawn individuals from those states. There's been a brain drain from Iowa, North Dakota and South Dakota, to Minnesota. And that's helped our labor force as well," says Stinson.

And some in Wisconsin say envy of the Badger State is misplaced.

"People here look up to Minnesota," says Joel Rogers, director of the Center on Wisconsin Strategy. The University of Wisconsin-based program is dedicated to improving economic performance and living standards in Wisconsin.

| |||

"The idea that we should be compared favorably to you on a tax basis, is, I think, sort of loony, actually," says Rogers.

He commends Minnesota's economic development programs, and says higher state spending appears to help prosperity.

"The broad direction of the evidence suggests that the states that tax more heavily, because they're spending more on basic infrastructure, both physical and immaterial, for example, education of their workforce, that heavier tax states are actually doing better than lower tax states," says Rogers.

But Bill Blazar with Minnesota's largest business group, the Minnesota Chamber of Commerce warns that much has changed in recent years.

"I'd be very, very careful before I would conclude that high taxes are a ticket to growth in the 21st century economy," says Blazar.

He says competition is global. Telecommunications make it easier for companies to send work to cheaper locations.

"It seems to me that we're actually more at risk. And that this economy has become more price- and expense-sensitive, which if anything suggests that taxes may be a bigger [negative] factor than they have been in the past," says Blazar.

He points to a recent survey of greater Minnesota manufacturers indicating more than half face intense competition from China. Lower costs in China were a major concern.

Gov. Pawlenty's finance commissioner, Dan McElroy, says Minnesota's spending rate of the past 30 years, can't continue for another 30.

"Every man woman and child in Minnesota would have to make $540,000 a year from cradle to grave, and I don't think that's likely. I'm not willing to bet the ranch on that. So, I think we have gotten benefits from our investments, benefits in workforce, in post-secondary education, and infrastructure, and now that we have those in place, I think we have to slow spending growth to where we're more competitive with the states we compete with for good paying jobs," says McElroy.

Gov. Pawlenty points to Minnesota's 2.1 percent decline in total non-farm jobs since the recession began 2 years ago.

"That is above the national average, in terms of rate of job loss, compared to the nation as a whole. And that concerns me greatly. And so, I don't think you can make the argument that Minnesota is under-taxed. I think you can make the argument that in these times we spend too much, and that's my perspective," the governor says.

Minnesota's rate of job loss is still less severe than those in Wisconsin and Michigan, comparable upper Midwest states. But is Minnesota losing its competitive advantage?

"That's the big question," says State Economist Tom Stinson. He says some things clearly have changed; for instance, the defense industry will be a more important part of the national economy. But defense work is not one of Minnesota's strong suits, and Stinson says that will be a drag on the state's economy.

"But productive workers -- productive, well-educated workers -- will be at a premium as the baby boom begins to retire. And so, to the extent that we have an advantage in productive, well-educated workers, the state is still going to do well," says Stinson.

He says the state might do better with lower taxes. But the question is whether that would reduce spending on training and education and erode the state's competitive advantage.

|

News Headlines

|

Related Subjects

|