Photos

More from MPR

Resources

Your Voice

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A look at the Senate DFL's tax plan

April 11, 2003

|

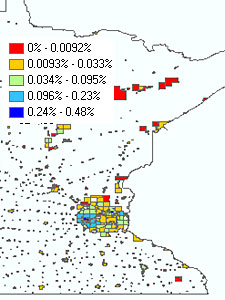

| This map shows the percentage of the population with a household income of $200,000 or more. Many are the target of a DFL tax plan. (MPR Research by Betsy Cole) |

St. Paul, Minn. — The Senate DFL plan would create a new tax bracket for families earning at least $250,000 a year. That would affect about one in 20 taxpayers.

Lynn Reed, research director of the non-partisan Minnesota Taxpayers Association, says the problem with a new top income tax rate is that it's too narrow.

|

People going to colleges and universities in Minnesota, they're going to have increases in their tuition, the MinnesotaCare families will have some increases in their premiums; I don't see how we can totally avoid that.

- Sen. Ann Rest, DFL-New Hope |

"Why should just one out of 20 contribute to this? That's really the bottom line for us; it seems to be proposing a tax increase but be embarrassed by it, so most people don't feel it," Reed says.

The new rate would be 9.4 percent on income above $250,000. That would be the third-highest top rate in the country, behind Montana and Vermont.

The labor-backed Citizens for Tax Justice supports the DFL proposal. Executive Director Wayne Cox says the rich benefitted from the income tax cuts of 1999 and 2000, and from the property tax reforms of 2001.

"The top one percent, on average, get this year $5,000 a year in individual income tax cuts from the state. So the state basically is taking back some of that income tax cuts to these higher-income people, rather than, for instance, under the governor's plan, asking 68,000 Minnesotans to be priced out of health insurance," Cox says.

Gov. Pawlenty says he won't raise state taxes, and his finance commissioner, Dan McElroy, says the DFL proposal is a bad idea. McElroy says the new top tax rate would put Minnesota at a competitive disadvantage.

"We don't particularly compete with Montana or Vermont for jobs. It's dramatically higher than the upper bracket in Wisconsin, Iowa, North or South Dakota, Michigan, Ohio, Indiana, Illinois, the states we really compete with," according to McElroy.

McElroy says while the tax would affect one in 20 taxpayers directly, he argues it could affect many others if their employers decide to move their companies out of state.

| |||

MPR analyzed data from the 2000 census to find out who would be directly affected by the DFL proposal. The census found that Minneapolis has the most families earning more than $200,000 a year. But those families make up just three percent of the total Minneapolis population. The largest concentrations of wealthy Minnesotans are in Twin Cities suburbs, many of them bordering Lake Minnetonka.

In Minnetonka Beach city, for example, nearly half of families earn more than $200,000 a year. In Edina, about one in six families could be subject to the proposed tax.

Rep. Ron Erhardt, R-Edina, says Republicans have been trying to reduce Minnesota's tax burden for years.

"I don't see any reason at this time to go the other way and start upping the taxes on higher brackets. To be equitable about it, I suppose if we were to increase the taxes, we should do it on everybody, but I'm not advocating that."

Senate DFL leaders say while their proposed new tax rate targets the wealthy, their plan as a whole spreads the pain among all Minnesotans.

Assistant Majority Leader Ann Rest of New Hope, a former Taxes Committee chair, says upper-income Minnesotans aren't singled out. "People going to colleges and universities in Minnesota, they're going to have increases in their tuition, the MinnesotaCare families will have some increases in their premiums; I don't see how we can totally avoid that. The business community is going to be asked to contribute, and, yes, the smokers and users of tobacco products are going to be asked to contribute," she says.

The Senate plan raises the cigarette tax by $1 a pack, and closes some unspecified corporate tax loopholes. Tax experts say those two taxes are regressive; the cigarette tax falls hardest on lower-income people, and corporate taxes are passed onto consumers.

The latest wrinkle in the tax debate is the House DFL plan. House Democrats want to lower income taxes for families who earn less than $500,000 a year, while imposing a temporary five-percent income tax on families earning more than that. Republican leaders say both proposals are "dead on arrival."

|

News Headlines

|

Related Subjects

|