Photos

More from MPR

Your Voice

| |||||||||||||||||||||||||||||||||||||||||||||

Poll Results: Most think taxes are too high

May 2, 2003

|

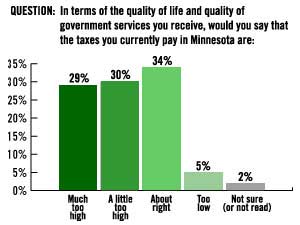

| Nearly 60 percent of respondents said their tax burden is too high. (Mason-Dixon Polling and Research) |

St. Paul, Minn. — The Mason-Dixon Minnesota Poll was conducted by Mason-Dixon Polling & Research, Inc. of Washington, D.C. April 29 through May 1, 2003. A total of 625 registered Minnesota voters were interviewed statewide by telephone. All stated they regularly vote in state elections.

Those interviewed were selected by the random variation of the last four digits of telephone numbers. A cross-section of exchanges was utilized in order to ensure an accurate reflection of the state. Quotas were assigned to reflect voter turn-out by county.

The margin for error, according to standards customarily used by statisticians, is no more than plus or minus 4 percentage points. This means that there is a 95 percent probability that the "true" figure would fall within that range if the entire population were sampled. The margin for error is higher for any subgroup, such as a regional or gender grouping.

QUESTION:In terms of the quality of life and quality of government services you receive, would you say that the taxes you currently pay in Minnesota are:

| Option | State | Men | Women |

| Much too high | 29% | 33% | 25% |

| A little too high | 30% | 29% | 31% |

| About right | 34% | 31% | 37% |

| Too low | 5% | 5% | 5% |

QUESTION:Do you feel the current Minnesota state budget deficit should be eliminated primarily through tax increases, or cuts in state spending?

| Option | State | Men | Women |

| Tax increases | 22% | 21% | 23% |

| Spending cuts | 50% | 52% | 48% |

| Combination | 23% | 24% | 22% |

| Not sure | 5% | 3% | 7% |

QUESTION: Based on what you know, which one of the following statements best reflects your view of how Gov. Pawlenty is dealing with the state's budget problems?

| Option | Percentage |

| He's cutting spending too much and should consider raising some taxes. | 28% |

| He's cutting spending the right amount but he's cutting the wrong things. | 34% |

| He's about right in both the amount of spending cuts and his priorities. | 30% |

| Not sure | 8% |

QUESTION: Here are three proposals to solve the state's $4.2 billion budget deficit. Which one of these do you support the most:

| Option | Percentage |

| Gov. Pawlenty has proposed solving the deficit mostly through reductions in spending, plus some fee increases. | 14% |

| The House Republican majority supports most of Pawlenty's budget plan, but wants to use $100 million from a state-operated casino to cushion some cuts in spending for cities, higher education and nursing homes. | 41% |

| The Senate DFL majority wants to use more than $1 billion from a cigarette tax increase, an income tax increase on individuals earning over $135,000 and families earning over $250,000 and an elimination of some tax breaks for businesses to cushion spending cuts. | 38% |

| Not sure | 7% |

QUESTION: The state’s $1 billion tobacco settlement fund is currently used to pay for tobacco prevention programs and services. Do you support or oppose transferring this money into the general fund and using it to fund other things?

| Option | State | Men | Women |

| Support | 57% | 59% | 55% |

| Oppose | 33% | 30% | 35% |

| Undecided | 10% | 11% | 10% |

QUESTION: Here is a list of several possible spending cuts that state officials are considering to help solve the budget deficit. Do you support making that cut, or would you prefer to pay higher taxes to avoid the cut?

- Cut $756 million from aid to local governments, which currently helps pay for local services and keeps property taxes lower?

| Option | State | Men | Women |

| Support the cut | 50% | 54% | 46% |

| Pay tax to avoid | 39% | 34% | 44% |

| Not sure | 11% | 12% | 10% |

- Cut $254 million from higher education, which could result in higher tuition for students at public colleges and universities?

| Option | State | Men | Women |

| Support the cut | 44% | 54% | 34% |

| Pay tax to avoid | 49% | 40% | 58% |

| Not sure | 7% | 6% | 8% |

- Cut $60 million from child care programs, which would eliminate subsidies for 1,100 families and raise out-of-pocket expenses for others?

| Option | State | Men | Women |

| Support the cut | 36% | 46% | 26% |

| Pay tax to avoid | 51% | 41% | 61% |

| Not sure | 13% | 13% | 13% |

- Cut $55 million from home and community-based services for the disabled?

| Option | State | Men | Women |

| Support the cut | 29% | 35% | 23% |

| Pay tax to avoid | 63% | 59% | 67% |

| Not sure | 8% | 6% | 10% |

- Cut $22 million from the Metropolitan Council's transit budget, which could result in higher bus fares and reduced bus routes?

| Option | State | Men | Women |

| Support the cut | 66% | 69% | 63% |

| Pay tax to avoid | 28% | 28% | 28% |

| Not sure | 6% | 3% | 9% |

QUESTION: To help solve the state's deficit, do you support or oppose having the state operate a casino at the Canterbury Downs race track?

| Option | State | Men | Women |

| Support | 70% | 74% | 67% |

| Oppose | 24% | 22% | 26% |

| Undecided | 6% | 4% | 7% |

QUESTION: To help solve the state's deficit, do you support or oppose raising income taxes on those individuals earning more than $135,000 and families earning over $250,000 a year?

| Option | State | Men | Women |

| Support | 77% | 72% | 82% |

| Oppose | 20% | 25% | 15% |

| Undecided | 3% | 3% | 3% |

QUESTION: To help solve the state's deficit, do you support or oppose raising the cigarette tax $1 per pack?

| Option | State | Men | Women |

| Support | 67% | 63% | 71% |

| Oppose | 30% | 35% | 25% |

| Undecided | 3% | 2% | 4% |

QUESTION: To help solve the state's deficit, do you support or oppose extending the sales tax to goods and services, like clothing and attorney's fees, which are currently tax-exempt?

| Option | State | Men | Women |

| Support | 30% | 27% | 33% |

| Oppose | 63% | 66% | 60% |

| Undecided | 7% | 7% | 7% |

|

News Headlines

|

Related Subjects

|