|

Photos

More from MPR

Resources

Your Voice

|

In a changed industry, Northwest sees quality service as an edge

June 2, 2003

Eagan-based Northwest Airlines is competing today in a different airline industry than it faced at the end of the 90s. Fewer Americans are flying. Southwest, AirTran, and other so-called low-cost carriers have taken 20 percent of the U.S. market. Northwest is competing on fares and trying to cut labor costs. But the airline also hopes to improve its position in the new marketplace by offering travelers better service in the air and on the ground.

St. Paul, Minn. — From the counter where Jim Coleman stands, Northwest travelers seem pretty satisfied these days. For five years Coleman has tended a small bar in the G Concourse of Minneapolis-St. Paul International Airport. Coleman knows a delayed passenger is a potential customer.

"Delays of half an hour to an hour are good for my business," Coleman says. "Anything over that, sucks. Because then you have people who are ... crabby, they're spending all their money here in the bar instead of being on vacation. So I notice it because I haven't had as many delays at this end of the airport, which is all Northwest, the G concourse."

It's not just the G gates at MSP. Northwest still ranks below many competitors, but the airline's on-time performance during the first quarter of this year improved over the year before.

| |||

This kind of improvement in service is arguably more important than ever. With low-cost airlines increasing competition for travelers, Northwest hopes to stand out from the pack by offering a better experience in the air and on the ground.

Joe Taney is Northwest's vice president of ground operations at MSP.

"Customers are booking carriers based on price. And for us, the mainline carriers we can, A, reduce our costs to be competitive with the low cost carriers, but also, B, figure out ways to line-bust, and figure out ways to make it more convenient for the customers to enter the airports to get on the flights," Taney says. "That's what we're really striving for all over at Northwest."

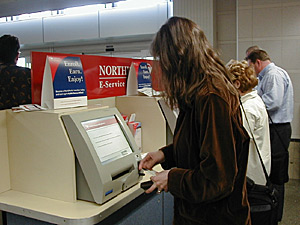

Northwest has invested in more technology to cut down on the time it takes to get through the airport. In April, 73 percent of Northwest passengers in the Twin Cities either checked in at home on their computers or at one of the airline's self-service kiosks. Northwest now has kiosks in every domestic airport it serves. At MSP travelers can now check-in on three different levels, or even across the street from the traditional ticket-counter lines.

New security measures remain an issue. In the Twin Cities, Northwest is working with the airport to route passengers to lesser-used security checkpoints that are closer to their gates. And Northwest recently reminded employees passengers could be bumped if they don't arrive early enough to get through security.

| |||

Heather Kjos of St. Paul is advancing swiftly through a short security line to get to a recent midday flight. She's been flying quite a bit lately, uses the kiosks and has rarely been held up in long lines.

"They haven't been too bad," Kjos says. "I usually do the e-ticket thing, and I never check baggage, so it seems pretty quick to me."

The airline is also hammering away at another potential sore spot for travelers. Northwest's most recent rate of mishandled baggage, reported in March, was half what it was the year before. A new automated baggage system at MSP has just been fully implemented.

Travel agent George Wozniak says in today's economy good service, a convenient schedule, and a frequent flyer program still count for something with air travelers. Wozniak owns Hobbit Travel, one of Minnesota's largest agencies. He says when the economy is poor, travelers simply want the best price. But in a strong economy, many will pay 100 dollars more to fly on a more established carrier like Northwest.

"I would say coming into this summer we're probably hovering somewhere right in between that," Wozniak says. "The difference between fares is probably going to be somewhere in the 40 to 60 dollar range for low-cost carriers to compete with 'the red-tail' out of this market."

In other words, Wozniak says Northwest can still lure travelers as long as it keeps fares somewhat close to its low cost competitors and gives flyers reasons to choose it. Being on-time helps. So does not losing bags. Northwest is also experimenting with extras like providing meals for customers willing to pay for them. Wozniak says a number of airlines are looking at bringing back food on an optional basis.

"We're going to have to wait and see whether the consumer would rather grab a bag of McDonald's burgers before they get on the plane, and eat those on the way, or buy what the airline may or may not have to offer," he says.

On a larger scale, Northwest expects to stick with its traditional "hub-and-spoke" model of air travel. Some critics have questioned the model's long-term viability. But Northwest says its elaborate network allows the airline to serve many more destinations than newer competitors and reach many smaller airports.

But as Northwest adjusts to new industry realities, travelers on some routes might find themselves on smaller airplanes than before. In Northwest's latest air traffic report, the airline's "load factor" continued to drop. That essentially means more empty seats.

If particular routes are looking thin, Northwest can look to its own smaller planes or turn to its regional partners, Mesaba and Pinnacle Airlines. Northwest Vice President Taney says their smaller turboprop and jet aircraft might often be a better fit.

"We change our schedules probably nine to 11 times a year just to make sure that we meet that proper market and city with the the demand that's required out of there," Taney says. "So as we see demand grow, we'll put up a larger aircraft. If we see it start to shrink, we can reduce the aircraft."

| |||

For passengers, smaller planes can mean fuller flights. Aaron Hadrick flies out of Sioux Falls for business, often on smaller Northwest Airlink planes, and says comfort can also be an issue.

"The little jets are pretty nice actually, because they're not any faster or slower than the big ones," he says. "The turboprops, they can get a little rough sometimes, just because they're so small and they're also really noisy inside."

As Northwest and other airlines try to get back in the black, consumers may worry their frequent flier miles could be a casualty. Tim Winship is the editor of FrequentFlier.com. He expects miles will gradually decline in purchasing power as airlines trim the extra seats in the air. Last year Northwest increased the number of miles for a round-trip coach ticket from 20 to 25 thousand, but also eliminated blackout dates. The airline says legal requirements prevent carriers from commenting on any future plans.

Over the long term, Winship says programs like Northwest's WorldPerks are not going anywhere.

"There is some nickel-and-diming of program members in terms of increased fees and award levels, Winship says, "but the programs are extremely successful as marketing programs and extremely profitable. As long as the airlines themselves survive."

Northwest wants to be seen as a survivor. Recent travelers might have noticed a new, more modern paint design appearing on the fleet. Vice President Taney hopes the new design sends travelers a signal of optimism about the future.

"We want to be known as a worldwide carrier," Taney says. "We want to be known as technically more advanced than most of the carriers out there. And to let people know that we're a survivor in this, we don't intend to go anywhere, we're going to be there, we're going to fly through this."

Northwest says a big part of flying through the current crisis will be cutting labor costs. Labor leaders have balked at new job and wage cuts proposed by the airline, and are studying Northwest's financial situation for themselves. More self-service check-in, smaller planes, and automated baggage systems all mean fewer workers are needed than before. But some workers say cuts have already gone deeper, leaving remaining employees overburdened.

Northwest says that's not their intention. In the coming months they hope to strike a difficult balance: Cutting their workforce while still maintaining the level of service they'll need to prevail.

|

News Headlines

|

Related Subjects

|