|

Audio

Photos

Your Voice

|

Officials: Bond sale goes well despite lowered credit rating

June 17, 2003

|

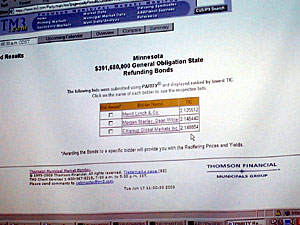

| Merrill Lynch & Co. outbid two other New York companies with an average interest rate of 2.1 percent. The sale was conducted online. (MPR Photo/Laura McCallum) |

St. Paul, Minn. — (AP) State finance officials said Tuesday they didn't detect fallout from Minnesota's freshly lowered credit rating during a bond sale that could yield the state $50 million in savings.

They were refinancing $391.7 million in bonds to take advantage of low interest rates. There was some fear that the savings would shrink because of Monday's decision by Moody's Investors Service to lower Minnesota's credit rating a notch.

| |||

Minnesota has the second-highest rating from Moody's and the top rating from the two other major Wall Street firms. Moody's downgraded Minnesota amid concerns over the budget balancing approach state leaders took.

But Tuesday was all smiles.

Merrill Lynch & Co. outbid two other New York companies with an average interest rate of 2.1 percent - far lower than Minnesota officials were expecting when they decided to refinance the bonds issued a decade ago at interest rates in the 5 percent range. The rates reflect the cost of borrowing money for construction projects.

"Whoa!" exclaimed Finance Commissioner Dan McElroy as he surveyed the bids. All three bids during the 30-minute online sale came in during the last 30 seconds. "We got great prices."

The preliminary estimate is that the transaction will save the state about $50 million over the original amount due on the bonds. Going in, state officials were predicting savings of about $40 million.

A $38.5 million chunk of the savings will arrive as part of a $430 million payment to the state next week. Much of the payment will be used to retire old debt later this summer.

"This was telling us that (Monday's) rating change didn't make a huge difference, at least for this sale," McElroy said.

Officials won't know for sure if the downgrade had a discernible impact until they analyze recent bond price trends.

Tuesday's sale was done in winner-take-all fashion. The winning bidder typically resells the state bonds in smaller increments to insurance companies, mutual funds and other investors, said Peter Sausen, an assistant finance commissioner.

|

News Headlines

|

Related Subjects

|