|

Audio

Photos

More from MPR

Resources

Your Voice

|

State looking over JOBZ proposals

November 12, 2003

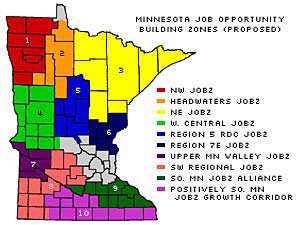

This week, state officials offered a look at Minnesota's proposed Job Opportunity Building Zones. The applications show communities in greater Minnesota went after the zones with gusto, carving out hundreds of tax-free islands around the state that they hope will lead to thousands of jobs down the road. Skeptics say all this work won't help -- and could even hurt -- the state economy in the long term.

St. Paul, Minn. — Flipping through the reams of paperwork from communities seeking "JOBZ" economic zones, one thing is clear -- the words "tax free" are a powerful motivation.

"It was absolutely enthusiastically embraced," says Louis Jambois, who is leading the effort to assess the applications at the state Department of Employment and Economic Development.

"The applications are very high quality. The applicants did essentially what we asked them to do, and then some," says Jambois. "It's an enormous statement about the situation in greater Minnesota."

By that, Jambois means the dire need for an economic boost in some parts of the state. JOBZ makes certain areas of undeveloped or abandoned land free from most property and corporate income taxes for 12 years. Companies won't pay sales tax on anything they build in the zones, and they'll get an additional tax credit for creating jobs that pay more than $30,000 a year.

| |||

But just relocating an existing Minnesota business to a zone is not enough. Only development that represents an increase in jobs or investment will qualify.

JOBZ was one of the first bills Gov. Pawlenty proposed after taking office, and Pawlenty calls the zones "the mother of all economic development incentives." He continues to defend them against critics who say the program constitutes dangerous meddling in the state economy.

"We've got to grow jobs in this state. Now I've got another tool, and I'm not going to be at all bashful about using those tax-free zones to keep jobs in Minnesota that would have been in Wisconsin or South Dakota or Iowa. These are good-paying jobs. It's critical to our quality of life," says Pawlenty.

So far, state analysts have waded through half of the applications. They say they're wielding a red pen when necessary to modify the proposals. Any cuts or adjustments will probably remain private until the zones are officially approved in January.

Based on the applications, 38,000 acres of Minnesota would turn tax-free. The 10 main zones are divided into 325 subzones. Many of these contain multiple separate patches of land. No one has counted how many of these patches there are -- it appears to number at least 1,000. Of the state's 80 non-metro counties, 78 would have some tax-free property.

| |||

Companies from outside Minnesota can move into a zone, or existing ones could expand there. Officials are banking on this second scenario in Park Rapids, where international frozen food maker Lamb Weston employs about 500 people. Dave Hengel of the Headwaters Regional Development Commission drew the Park Rapids subzone right along the edges of the Lamb Weston potato chip plant.

"Quite often, what happens is they will have to compete for an expansion, even within their company. So by having that adjacent to their existing plants, that becomes an opportunity for them to compete for those expansions," says Hengel.

The approach is quite different in Kerkhoven, a town of 800 in west central Minnesota. Kerkhoven would turn much of its struggling downtown into a tax-free zone, including a former car dealer, a former egg plant, a former church, and a former gas-station -- a tiny subzone of one-tenth of an acre. Sue Pirsig with the group Swift County GROW hopes the proposal will draw both local and non-local entrepreneurs.

"They haven't attracted a lot of businesses in the past," says Pirsig. "They're hoping that this kind of program will make them more attractive to someone that would consider locating in a small town. It's very difficult for these small towns to survive."

Pirsig and other officials are hard-pressed to put an actual number on their hopes for jobs created by the zones. But she says in western Minnesota, she knows of "several" companies already tempted by the prospect of tax-free expansion.

|

They're hoping that this kind of program will make them more attractive to someone that would consider locating in a small town. It's very difficult for these small towns to survive.

- Sue Pirsig, Swift County GROW |

Louis Jambois says areas around the state are seeing something similar.

"We know there are communities out there that are courting businesses right now, and there are businesses hanging in the weeds waiting to see what areas are designated," says Jambois.

That's a troubling image to Art Rolnick, research director at the Federal Reserve Bank of Minneapolis.

"You really want your companies to be efficient, and making decisions based on sound economic fundamentals, not based on where the subsidy lies," he says.

Rolnick says companies should go where the infrastructure, labor force, and natural amenities will best allow them to succeed.

"If this is the wrong place for a business to locate, if it's sort of a second-best decision -- and they would have been better off in another county, another state -- then I think it's questionable if it's going to be sustainable," says Rolnick.

Rolnick and some lawmakers also worry the tax exemptions will simply tempt companies to expand in one part of Minnesota instead of another.

That's what might happen in Kanebec County. Sara Jayne Treiber of the East Central Regional Development Commission says a manufacturer looking to expand in bustling Sherburne County is now eyeing a tax-free spot in rural Mora, much farther from the Twin Cities.

"That's what the people in Mora really want. They want people to take a look at them and see, maybe it would work out," says Treiber.

Gov. Pawlenty says giving a boost to certain areas over others is the whole point of the program.

"I've read the editorials, the Federal Reserve and Art Rolnick's comments around the JOBZones. The bottom line is, I wish all of Minnesota was more competitive. I wish the state was more competitive in terms of jobs, but in some respects it isn't. And so we've got to ad-lib a little bit if we're going to keep these jobs here," says Pawlenty.

If early signals are any indication, many tax-free zones will see some new business activity. But that does not necessarily mean the zones deserve the credit. As companies settle in for 12 years without paying state or local taxes, Art Rolnick says one question should continue to haunt policy-makers.

"Many times, we suspect you're subsidizing something the private sector would have done anyway," says Rolnick.

One early example adds some fuel to this fire. Polaris, the Twin Cities-based maker of snowmobiles and ATVs, will open a research and testing facility on 600 acres in Wyoming Township. The land is a proposed tax-free plot about 30 miles north of St. Paul. The application for tax-free status, filed in October, already states that the land will be used by Polaris, and that the company will purchase the land for $10 million.

At the time the application was filed, township and state officials had already been in negotiations with Polaris for at least six months -- securing, among other things, a $1 million state grant for road repair.

For critics, this is evidence Minnesota is loading tax exemptions on top of an already done deal.

Chris Eng drafted the application as head of the Chisago County Housing and Redevelopment Authority, and is also chair of the Wyoming Township Board. He says the tax-free zone was critical to sealing the deal with Polaris.

"We were pretty confident that if we hadn't had this program in place, they would be in Wisconsin right now," says Eng. "The JOBZ program really leveled that playing field. It put us on a level field with Wisconsin, and I don't think they'd be here without it."

Eng says the tax-free zone gives Minnesota a response to the Wisconsin Technology Zone tax credit across the border. But Rolnick of the Federal Reserve says the zones will only spur on an escalating battle of economic incentives, as Minnesota and neighboring states raid each others' companies.

"Wisconsin is going to respond," says Rolnick. "The end result of these bidding wars is not new jobs for Minnesota or Wisconsin. It's simply some subsidies for some private businesses."

The governor shares Rolnick's war analogy, saying Minnesota is in "a dogfight for jobs." But to Pawlenty, it's a battle that must be fought. Come January, the tax-free zones will be a prominent new weapon.

|

News Headlines

|

Related Subjects

|