|

Photos

More from MPR

Your Voice

|

Minnesotans more likely to get hit by AMT -- twice

April 13, 2004

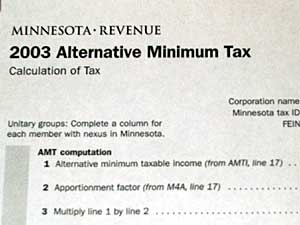

Congress created a special tax a generation ago in hopes of forcing all Americans, even those with numerous deductions, to pay at least some income tax. Minnesota followed suit and established its own alternative minimum tax in the late 1970s. Experts say both taxes no longer serve their original purposes. Increasingly, the "alternative minimums" are catching middle-income workers, not the wealthy tax avoiders they were designed to reel in.

St. Paul, Minn. — Everyone, regardless of income, is required to calculate their taxes two ways. Under the law, you're required to pay the higher of the two tax calculations: conventional or the alternative minimum.

The first is the traditional tax model -- basically, your income minus whatever deductions you have. Those could be deductions for children, or for state and local taxes already paid.

| |||

The second is the calculation for the Alternative Minimum Tax, or AMT.

Tax preparer Kathy Olson says the AMT comes with its own set of rules. Olson says the AMT is calculated without most of the popular tax deductions many Americans have come to count on.

"Things are not allowed under the Alternative Minimum Tax preparation," Olson says. "There's no deduction allowed for children, no itemized deductions for employee business expenses, state income taxes."

Minnesota established its AMT in the late 1970s, several years after the federal government came up with the idea. Both AMTs were designed to catch wealthy Americans who, through tax shelters and deductions, were eluding income taxes.

Compared to people living in other states, Minnesotans are more likely to run up against alternative minimum taxes.

|

We have clients that are making $100,000 a year. They're not taking advantage of tax shelters. ... They've got some interest, they've got some dividends, they pay their mortgage, they pay their real estate taxes. And boom, they're finding themselves in the AMT.

- Accountant David Levi |

Accountant David Levi says on the federal side, Minnesota's high state and local taxes make getting hit by the AMT more likely, since those taxes are not deductible in the AMT calculation.

On the state side, Levi says unlike most states, Minnesota's AMT does not allow mortgage interest deductions, once again making Minnesotans more vunerable to the higher tax.

"For a person who's not on the federal AMT, 99 times out of 100 if they get into the state AMT it will be because of mortgage interest," Levi says. "That is really the biggest difference between the two."

Levi calls the federal and state AMTs traps, which are increasingly snaring middle-class Americans -- hardly the wealthy tax avoiders they were designed to catch.

"We have clients that are making $100,000 a year. They're not taking advantage of tax shelters. They're not going out and doing anything that's real exotic from an investment standpoint," Levi says. "They invest, they've got some interest, they've got some dividends, they pay their mortgage, they pay their real estate taxes. And boom, they're finding themselves in the AMT."

Levi says he's seen a dramatic increase this year from last. He estimates about 25 percent more of his clients are having to pay the federal AMT. He says about 10 percent to 15 percent more are paying the state AMT.

Levi broadly estimates that the AMT increases tax bills by about 5 percent. That's enough to nearly wipe out the Bush tax cuts approved by Congress. Those tax cuts pushed more Americans onto the AMT because their conventional tax burden decreased.

| |||

Every year, more Minnesotans are also paying the state AMT. In 1995 about 5,300 Minnesotans had to pay the minimum tax. More than 35,000 paid it in the 2002 tax year. That number is projected to nearly triple within three years.

Sen. Ann Rest, DFL-New Hope, who's also an accountant, says she would like to see the AMT repealed. But Rest says that would cost the state too much money, so she recommends gradually reining in the tax. She's proposing several changes that would put more space between middle-class Minnesotans and the state AMT.

Among other things, Rest wants some mortgage interest deductions allowed. She also wants AMT income exemptions increased.

"I think that we need to start to turn it around, and we can do that by phasing in some tax relief for these taxpayers that we don't want to be subject to the AMT. But we've got to start it now," Rest says.

Rest says the longer Minnesota lawmakers wait to reform the AMT, the more difficult and more expensive the job will be.

|

News Headlines

|

Related Subjects

|