Audio

Photos

More from MPR

Resources

| ||||||||||||||||||||||||||||||||||||||

February 25, 2005

|

| Officials say they're concerned at the high number of Latinos in the state who have lost their health insurance. (Photo by Tim Boyle/Getty Images) |

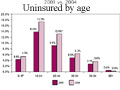

St. Paul, Minn. — The survey shows that Minnesota still has one of the lowest rates of uninsured residents in the nation. But the Minnesota Health Access survey says there's been a 30-percent increase in the number of uninsured between 2001 and 2004.

The University of Minnesota's Kathleen Call says fewer employers are offering health coverage to their employees or they're offering coverage that their employees can't afford. "We're seeing a shift away from some of the larger employers that typically offer health insurance coverage. We're seeing a shift away from manufacturing jobs and when people leave manufacturing jobs, what we see is a shift into other jobs that are less likely to offer insurance coverage," according to Call.

Call says the percentage employers offering health insurance declined from 70 percent in 2001 to 63 percent in 2004.

Carolyn Jones, with the Minnesota Chamber of Commerce, says many employers have been complaining about rising health care costs for the past five years. Her organization released a survey earlier this year which said many businesses were thinking about dropping their coverage.

"We lead the nation in terms of employer health insurance coverage and I think that has helped us keep our costs down and are uninsured rate down. It's a very troubling trend," she says.

Jones says state lawmakers should allow HMOs to offer a greater variety of affordable options. That would require a change in laws that mandate what procedures insurers must cover. She also says they should allow Health Savings Accounts, tax free savings accounts coupled with high deductible medical insurance.

Diane Peterson is among the recently uninsured. She lost her health insurance in September when she started working at a Krispy Kreme store. The 52-year-old Roseville resident says she can't enroll in her company's health insurance plan until next September.

"I've had insurance all of my life," Peterson says. "That's one thing my dad always said is 'All it takes is one time and that's it. You're in debt the rest of your life."

But now Peterson is in a troubling position. In January, she admitted herself to Regions Hospital for chest pains. Doctors conducted several tests and determined that she needed an angioplasty. Peterson declined the procedure because she couldn't afford it.

"I'm seriously thinking about not having these procedures and not going through with it because I don't want to be in debt the rest of my life. I'd rather just maybe live the life I can and when I drop I guess I have to," Peterson says.

Jim Koppel worries that more people will end up in Peterson's position. He says employers are dropping coverage at the same time that Gov. Pawlenty is recommending cuts to MinnesotaCare, a state subsidized health insurance program. The governor's budget proposal would cut at least 27,000 people from MinnesotaCare.

Koppel says the program is directed at the very group that is losing coverage through employers.

"When the headline says Minnesota continues to have the lowest insured rates or one of the lowest uninsured rates in the country - right underneath that it should say this country has 45 million uninsured people and it's getting worse and it's getting worse in every state and we're not doing a thing about it," according to Koppel.

Officials say they're also concerned at the high number of Latinos in the state who have lost their health insurance. The Minnesota Health Department's Scott Leitz co-authored the survey. He says 60 percent of the Latinos surveyed in 2001 had employer based coverage. In 2004, the number fell to 36 percent of the population.

"We don't see any real changes that occurred in terms of the work patterns of Hispanic/Latinos which means they're very likely to be employed and tend to be working thirty hours a week or more but that the income levels being earned off of those jobs are very low and come without health insurance benefits attached," Leitz says.

The survey is based on interviews with nearly 14,000 Minnesotans between July and December of last year.