Ventura Proposes 'Leaner' Increase in Education Spending

By Tim Pugmire

January 23, 2001

Part of MPR's online coverage of Gov. Ventura's budget proposal.

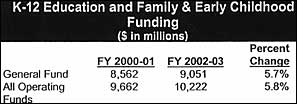

Gov. Ventura says he wants to hold the line on spending this year, and his plans for K-12 education are as lean as the rest his biennial budget. Overall, his proposal provides only inflationary increases in school funding. A handful of education programs would get more state money, but some legislative leaders say it's not enough.

GOV. VENTURA SAYS K-12 EDUCATION was the big winner in his last budget two years ago when state spending on public schools jumped by $1.3 billion. His new biennial education proposal pales in comparison, with a spending increase of just $489 million.

"That $1.3 billion increase in funding doesn't magically go away when this budget cycle ends. It will be there again in this next budget cycle. Is it enough to do the job? Well, with all due respect to those who believe we can never put enough into education, I believe, with a little help, it is," Ventura says.

Ventura's "little help" comes in the form of $123 million in new money for initiatives including: Indian education grants, school breakfast programs, assistance to struggling schools, a statewide school accountability program and more state tests.

The governor says he also wants school districts to begin paying teachers based on their classroom performance, not how long they've been on the job.

"I'm recommending $15 million this biennium for districts and school sites that are interested in trying alternative approaches to compensation, rather than the traditional 'steps and lanes,'" Ventura said.

Ventura's education commissioner, Christine Jax, says the state incentive of $150 per pupil will initially benefit about 10 school districts. She says money will also go toward teacher retention and recruitment programs, including a college-loan forgiveness program for new teachers.

"We think that what we're doing especially to support the teaching profession, is really going to make a difference. Not just keeping the great teachers we have, but getting young people interested in the field and getting people that are in other careers interested in shifting over," he said.

Key legislators are giving mixed reviews to the Ventura education plan. DFL Sen. Leroy Stumpf, chairman of the Senate K-12 Finance Division, says he's pleased to see the loan forgiveness proposal and other initiatives aimed at addressing the growing teacher shortage. But he says he's disappointed with the overall level of spending for schools. Stumpf also says the governor's targeted spending misses a lot of critical education needs.

"Whether it be declining enrollment school districts, or whether it be special education, early childhood, all of those programs I think are important programs that are looking for some additional resources," Stumpf said.

Rep. Alice Seagren, R-Bloomington, chairwoman of the House K-12 Finance Committee, agrees. She says many education concerns were left unaddressed in Ventura's budget, which she describes as "pretty thin."

"What I'm hearing from districts is that while an inflationary increase is helpful, there's still a lot of spending needs that they have out there. So, I think what the debate will be whether we want to go on beyond what the governor has proposed, and how much we agree to putting into education," Seagren said.

Seagren says the cost of the governor's tax-reform plan, which takes basic K-12 funding off from the property tax, limited his spending options. She says he also ensured a slow legislative process by linking the new spending to the success of the tax plan.

Education Commissioner Jax says school districts and education groups always have reasons to complain about needing more money. But she says they need to recognize the additional help they'll get from the tax reform and tax relief portions of the governor's plan. "What I'm hoping is that they'll look at the entire package and see that there's going to be tax relief for their district, so they'll have more capacity to raise money, go directly to their voters and get they money they need, if they think they need more. And they're going to see that with $1 billion in permanent tax reduction going back to the people and $1 billion in a surplus going back to the people, that the citizens will have more money and more access and the ability to help their children," Jax said.

Tim Pugmire covers K-12 education issues for Minnesota Public Radio. Reach him via e-mail at tpugmire@mpr.org

By Tim Pugmire

January 23, 2001

Part of MPR's online coverage of Gov. Ventura's budget proposal.

|

|

RealAudio |

Gov. Ventura says he wants to hold the line on spending this year, and his plans for K-12 education are as lean as the rest his biennial budget. Overall, his proposal provides only inflationary increases in school funding. A handful of education programs would get more state money, but some legislative leaders say it's not enough.

| |

|

|

|

||

"That $1.3 billion increase in funding doesn't magically go away when this budget cycle ends. It will be there again in this next budget cycle. Is it enough to do the job? Well, with all due respect to those who believe we can never put enough into education, I believe, with a little help, it is," Ventura says.

Ventura's "little help" comes in the form of $123 million in new money for initiatives including: Indian education grants, school breakfast programs, assistance to struggling schools, a statewide school accountability program and more state tests.

The governor says he also wants school districts to begin paying teachers based on their classroom performance, not how long they've been on the job.

"I'm recommending $15 million this biennium for districts and school sites that are interested in trying alternative approaches to compensation, rather than the traditional 'steps and lanes,'" Ventura said.

Ventura's education commissioner, Christine Jax, says the state incentive of $150 per pupil will initially benefit about 10 school districts. She says money will also go toward teacher retention and recruitment programs, including a college-loan forgiveness program for new teachers.

"We think that what we're doing especially to support the teaching profession, is really going to make a difference. Not just keeping the great teachers we have, but getting young people interested in the field and getting people that are in other careers interested in shifting over," he said.

Key legislators are giving mixed reviews to the Ventura education plan. DFL Sen. Leroy Stumpf, chairman of the Senate K-12 Finance Division, says he's pleased to see the loan forgiveness proposal and other initiatives aimed at addressing the growing teacher shortage. But he says he's disappointed with the overall level of spending for schools. Stumpf also says the governor's targeted spending misses a lot of critical education needs.

"Whether it be declining enrollment school districts, or whether it be special education, early childhood, all of those programs I think are important programs that are looking for some additional resources," Stumpf said.

Rep. Alice Seagren, R-Bloomington, chairwoman of the House K-12 Finance Committee, agrees. She says many education concerns were left unaddressed in Ventura's budget, which she describes as "pretty thin."

"What I'm hearing from districts is that while an inflationary increase is helpful, there's still a lot of spending needs that they have out there. So, I think what the debate will be whether we want to go on beyond what the governor has proposed, and how much we agree to putting into education," Seagren said.

Seagren says the cost of the governor's tax-reform plan, which takes basic K-12 funding off from the property tax, limited his spending options. She says he also ensured a slow legislative process by linking the new spending to the success of the tax plan.

Education Commissioner Jax says school districts and education groups always have reasons to complain about needing more money. But she says they need to recognize the additional help they'll get from the tax reform and tax relief portions of the governor's plan. "What I'm hoping is that they'll look at the entire package and see that there's going to be tax relief for their district, so they'll have more capacity to raise money, go directly to their voters and get they money they need, if they think they need more. And they're going to see that with $1 billion in permanent tax reduction going back to the people and $1 billion in a surplus going back to the people, that the citizens will have more money and more access and the ability to help their children," Jax said.

Tim Pugmire covers K-12 education issues for Minnesota Public Radio. Reach him via e-mail at tpugmire@mpr.org

Top | The Budget | Health Care | Higher Education

K-12 Education | Public Safety | Transportation| Home

K-12 Education | Public Safety | Transportation| Home