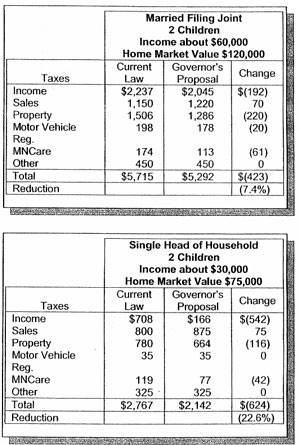

How Your Tax Bill Would Change

Source: Executive Budget Summary

The Goals of Tax Reform

The governor's tax reform and relief proposals are the product of an 18-month effort to listen and talk with taxpayers, legislators, and local and state government officials across Minnesota about the state and local tax system. The focus of the discussions was on how the tax laws can be changed to better meet the needs of taxpayers, continue to support needed government services in a changing economy, and better align with the governor's Big Plan strategic vision for the state.

In public dialogues, stakeholder meetings, focus groups, surveys, and interviews with state and local officials, concerns and hopes for changes in the tax laws focused on these general themes:

The governor's key recommendations for reforming the tax system are:

Focusing on the bottom line: Significant tax relief combined with fundamental tax reform

The governor's recommendations reduce overall state and local taxes by over $1 billion annually in FY 2003, and reduce the reliance on both the property and income tax in the state and local revenue system. Under the governor's recommendation, the sales tax will replace the property tax as the second-largest revenue source after the individual income tax, with an overall reduction in tax burden.

Fairness and balance among businesses and individuals, regions, and income levels

The key concern of Minnesota citizens and policymakers is for fairness and balance of tax burdens between business and individual taxpayers, between metro and Greater Minnesota communities, and across various levels of household income. The governor's reform and relief recommendations have been developed with those concerns in mind. Preliminary estimates indicate that the overall distribution of tax relief under the governor's proposal will be consistent with the current distribution of tax burdens, although a detailed analysis of tax incidence impact in comparison to current law projections will not be available until March 2001.

How will the plan affect individual taxpayers?

The governor's tax reform and relief proposal makes a number of simultaneous changes in the tax laws - many of those offsetting the others within the entire tax system. As with the overall state and local revenue system, the bottom line effects on individual taxpayers reflect the sum total of these changes.

How will the plan affect business taxpayers?

The governor's tax reform and relief proposal makes a number of significant changes to the way Minnesota taxes business - providing net relief of more than $330 million per year. This is important, not only for Minnesota's competitive position in a changing economy, but also because business taxes ultimately affect individual workers and households.

Under current law, businesses pay about 33 percent of total state and local taxes, Minnesota households pay 64 percent, and non-residents pay the remainder. (This is what's called "initial incidence," before business taxes are ultimately passed along to households through product prices, wages and benefits, or profits.)

Under the governor's proposal, net tax relief to businesses and Minnesota households is estimated to be distributed in the same proportion as current taxes: 33 percent to businesses, and 64 percent to households.

How will the governor's plan affect the regional distribution of tax relief?

Under current law, total state and local tax collections in the seven-county metropolitan area are estimated to account for 66 percent of the statewide total. Under the governor's proposal, the percentage of total state and local taxes paid in the metropolitan area is expected to remain at about the same level - roughly 66 percent. In the property tax component of the proposal, the relative tax relief in Greater Minnesota is larger than in the metropolitan area; under current law, property taxes in the 80 non-metro counties account for 35 percent of total property taxes statewide. Under the governor's proposal, about 40 percent of the net property tax reduction occurs in those same counties.

How will the governor's plan affect the overall incidence of the tax system?

The governor's recommendations have been designed to maintain the current roughly equal proportional distribution in overall tax burdens (direct and indirect) among households at various income levels. Reductions in both the income and property tax, continued sales tax exemptions for food, clothing, heating fuels, and other essential items, and increases in the state Working Family Credit and the maximum homeowner property tax refund are intended to maintain a balanced distribution of overall tax relief among Minnesota households. As indicated previously, a complete updated tax incidence analysis of current law will be available in March 2001.

Sales Tax Rebate

The governor recommends a $925 million sales tax rebate. This is the amount that was certified as available for rebate in November. This rebate will "settle up" with taxpayers for tax year 2000-01. As with the last two rebates, it will be mailed directly to eligible taxpayers next summer. The average rebate amount is expected to be approximately $440 ($590 for couples and $300 for singles).

School Funding and Property Tax Reform

The governor's recommendations for property tax reform and relief are designed to make the property tax smaller, fairer, more local and more accountable to taxpayers by eliminating state mandated costs from the property tax. Under current law, the general education levy will add about $900 million to property tax bills in 2001. The single greatest direct, state-mandated spending driver in the local property tax is the general education levy, now used to fund a portion of the state-set, per-pupil general education formula. Removing this levy allows for meaningful class rate reform, because it is a major contributor to overall tax rate disparities between business and rental housing and other properties.

The governor's proposals for reforming the property tax system are:

In combination with reform of the school finance reliance on the property tax, the governor's recommendation also includes reforms of the property tax classification system and of state aid payment formulas for cities, counties, townships, and individuals. Major features include:

The net effect of the governor's recommendations for school finance reforms (including the new general fund levy), property tax classification reforms, and changes in state payment formulas to other local governments is a reduction in property taxes statewide of approximately $800 million per year.

The impact of the governor's recommendations is to significantly reduce the disparities in effective tax rates among various property types that exist under current law. This is especially true for the "local" portion of the property tax.

Sales and Use Tax Reform

The governor's proposal will have the state and local tax system rely less on property and income taxes, and more on the sales tax. The proposal would align sales tax treatment of the service economy (which is largely untaxed) more with the goods economy (which is basically taxed), reduce the rate to six percent, and expand the exemption for capital equipment and business inputs.

In Minnesota, as in many other states, the sales tax has come under growing pressure as a revenue source. The economy has changed as consumption has shifted more from goods toward services. Minnesota's sales tax was first imposed in 1967 on goods only (minus food and clothing), a time when services made up just over 40 percent of total consumption. Since then, services have grown to consume 60 percent of consumer expenditures, yet the sales tax still applies to only a small, select group of services. Minnesota's sales tax is increasingly out of step with the modern economy.

Moreover, the growth of e-commerce and Internet sales - while essential for economic growth - are causing a growing tax loss because sellers from outside Minnesota don't collect and remit the sales and use tax. In the process, Minnesota retailers find themselves at a competitive disadvantage.

Finally, Minnesota has a high state sales tax rate - at 6.5 percent, the third-highest in the country. That high tax rate makes routine purchases for consumers more costly than they otherwise would be, and when imposed on business equipment and supplies, increases the cost of doing business in Minnesota.

The governor's proposal for sales and use tax reform is to preserve and modernize the sales and use tax so that it can continue to serve as a viable alternative to property and income taxes. Citizens told us that while they want overall tax burdens reduced, they would be more willing to trade off the sales tax with the income and property tax, because the sales tax is more within their own control than income and property taxes.

The governor's sales and use tax reform proposal is based on the following principles:

The individual income tax is the largest revenue raiser in the state budget. Despite reductions enacted during the 1999 and 2000 legislative session, Minnesota's rates remain high in comparison to other states (the 10th-highest top rate and the third-highest starting rate). Income tax ubrdens continue to be cited as a competitive disadvantage in attracting and retaining highly-skilled and productive workers to the state. In addition, Minnesota's income tax laws have become increasingly complex in the period since major simplifications were last achieved in the 1980s.

The governor's recommendations for individual income tax reform and relief are designed to reduce income tax burdens for all taxpayers, and achieve simplifications in tax calculations and penalties:

The governor recommends repeal of the HMO premium tax and the wholesale drug tax, eliminating the scheduled 0.5 percent increase in the provider tax and limiting future reliance on the provider tax by permanently limiting it to 1.5 percent. Under current law, the HMO premium tax would be required to "blink on" and the provider tax revert to a two percent rate. Ongoing funding in the Health Care Access Fund is assured by a dedication of 85 percent of cigarette excise tax proceeds, beginning in FY 2004. This is in addition to recommending transferring selected program expenditures to the general fund.

Motor Vehicle Registration Tax Relief

The governor recommends reductions in the motor vehicle registration tax. Beginning in January 2002, the maximum tax for the first year registration would be $189 and the maximum tax for subsequent registration years would be $89. Beginning in January 2004, the maximum tax for all registration years would be $75. Combined with last year's action, these additional steps will lead to a total reduction of approximately 40 percent in FY 2003. The loss to the Highway User Fund will be replaced by dedicating a specified percentage of the motor vehicle sale tax (MVST) to the highway fund. The recommended MVST dedication is 39 percent in FY 2002 and grows to 61 percent in FY 2005. This will fully reimburse the highway fund for the previous license tab cut, the additional tab cut proposed, and the sales tax rate cut.

Corporate Tax Relief and Reform

The governor is also recommending additional business tax relief, including a corporate income tax rate reduction of 9.4 percent, and 90 percent sales weighting in the apportionment formula (accompanied by base-broadening reforms which partially offset the reduction).

These changes must also be viewed in the context of approximately $300 million in property tax relief that business will receive under the governor's property tax proposal.

Other Tax Changes

The governor is also recommending other tax changes, including:

Source: Executive Budget Summary

The Goals of Tax Reform

The governor's tax reform and relief proposals are the product of an 18-month effort to listen and talk with taxpayers, legislators, and local and state government officials across Minnesota about the state and local tax system. The focus of the discussions was on how the tax laws can be changed to better meet the needs of taxpayers, continue to support needed government services in a changing economy, and better align with the governor's Big Plan strategic vision for the state.

| |

|

|

|

||

- Ensuring a fair distribution of tax burdens.

- Simplifying government budget and tax policies so taxpayers and public officials alike can better predict, understand and control them.

- Achieving and maintaining economic prosperity across Minnesota.

- Reduce the property tax and return it to local control by eliminating state-mandated impacts.

- Preserve and enhance the sales tax as a source of revenue, and modernize it to fit a changing economy.

- Emphasize local government revenue flexibility and accountability to taxpayers.

- Improve the competitive position of Minnesota workers and firms in the increasingly global marketplace.

The governor's key recommendations for reforming the tax system are:

- Immediately rebate $925 million, the current year surplus, to "settle up" with taxpayers.

- Reform property tax and K-12 education finance by fully funding the general education formula without reliance on a state-mandated property tax levy. This change will result in significant property tax relief of about $800 million per year combined with reform of the property tax classification system and state aids systems.

- Modernize the sales tax to fit today's economy by imposing the sales tax equitably between goods and services, lowering the rate, and adopting other changes designed to improve collection of the sales tax in the face of the growing challenge of electronic commerce.

- Lower income tax rates in all brackets by 0.4 percent immediately, and increase the state Working Family Credit to continue recent progress in reducing Minnesota's nationally-high individual income tax burdens.

- Reduce health care taxes by repealing taxes on HMO premiums and wholesale prescription drugs, and eliminating the scheduled increase in the provider tax of 0.05 percent. The governor proposes reducing our reliance on the provider tax by permanently limiting it to 1.5 percent, and also dedicating a share of the existing cigarette excise tax receipts to health care purposes.

- Reduce motor vehicle registration (license tabs) taxes to continue progress toward the governor's goal that no auto registration tax exceed $75.

Focusing on the bottom line: Significant tax relief combined with fundamental tax reform

The governor's recommendations reduce overall state and local taxes by over $1 billion annually in FY 2003, and reduce the reliance on both the property and income tax in the state and local revenue system. Under the governor's recommendation, the sales tax will replace the property tax as the second-largest revenue source after the individual income tax, with an overall reduction in tax burden.

Fairness and balance among businesses and individuals, regions, and income levels

The key concern of Minnesota citizens and policymakers is for fairness and balance of tax burdens between business and individual taxpayers, between metro and Greater Minnesota communities, and across various levels of household income. The governor's reform and relief recommendations have been developed with those concerns in mind. Preliminary estimates indicate that the overall distribution of tax relief under the governor's proposal will be consistent with the current distribution of tax burdens, although a detailed analysis of tax incidence impact in comparison to current law projections will not be available until March 2001.

How will the plan affect individual taxpayers?

The governor's tax reform and relief proposal makes a number of simultaneous changes in the tax laws - many of those offsetting the others within the entire tax system. As with the overall state and local revenue system, the bottom line effects on individual taxpayers reflect the sum total of these changes.

How will the plan affect business taxpayers?

The governor's tax reform and relief proposal makes a number of significant changes to the way Minnesota taxes business - providing net relief of more than $330 million per year. This is important, not only for Minnesota's competitive position in a changing economy, but also because business taxes ultimately affect individual workers and households.

Under current law, businesses pay about 33 percent of total state and local taxes, Minnesota households pay 64 percent, and non-residents pay the remainder. (This is what's called "initial incidence," before business taxes are ultimately passed along to households through product prices, wages and benefits, or profits.)

Under the governor's proposal, net tax relief to businesses and Minnesota households is estimated to be distributed in the same proportion as current taxes: 33 percent to businesses, and 64 percent to households.

How will the governor's plan affect the regional distribution of tax relief?

Under current law, total state and local tax collections in the seven-county metropolitan area are estimated to account for 66 percent of the statewide total. Under the governor's proposal, the percentage of total state and local taxes paid in the metropolitan area is expected to remain at about the same level - roughly 66 percent. In the property tax component of the proposal, the relative tax relief in Greater Minnesota is larger than in the metropolitan area; under current law, property taxes in the 80 non-metro counties account for 35 percent of total property taxes statewide. Under the governor's proposal, about 40 percent of the net property tax reduction occurs in those same counties.

How will the governor's plan affect the overall incidence of the tax system?

The governor's recommendations have been designed to maintain the current roughly equal proportional distribution in overall tax burdens (direct and indirect) among households at various income levels. Reductions in both the income and property tax, continued sales tax exemptions for food, clothing, heating fuels, and other essential items, and increases in the state Working Family Credit and the maximum homeowner property tax refund are intended to maintain a balanced distribution of overall tax relief among Minnesota households. As indicated previously, a complete updated tax incidence analysis of current law will be available in March 2001.

Sales Tax Rebate

The governor recommends a $925 million sales tax rebate. This is the amount that was certified as available for rebate in November. This rebate will "settle up" with taxpayers for tax year 2000-01. As with the last two rebates, it will be mailed directly to eligible taxpayers next summer. The average rebate amount is expected to be approximately $440 ($590 for couples and $300 for singles).

School Funding and Property Tax Reform

The governor's recommendations for property tax reform and relief are designed to make the property tax smaller, fairer, more local and more accountable to taxpayers by eliminating state mandated costs from the property tax. Under current law, the general education levy will add about $900 million to property tax bills in 2001. The single greatest direct, state-mandated spending driver in the local property tax is the general education levy, now used to fund a portion of the state-set, per-pupil general education formula. Removing this levy allows for meaningful class rate reform, because it is a major contributor to overall tax rate disparities between business and rental housing and other properties.

The governor's proposals for reforming the property tax system are:

- Eliminate the general education levy and fully fund the general education formula from state resources.

- Place responsibility for voter-approved additional school operating levies on residential (homeowner and apartment) or "voting" properties only, to promote greater local control and accountability over these spending and tax decisions.

- Increase state equalization aid for operating referendum levies to allow voters in property-poor school districts to generate additional operating dollars with comparable tax rates as voters in wealthier districts.

- Create a new statewide General Fund (property tax) levy on business and seasonal properties or "non-voting" properties at a reduced level. The new statewide levy would provide that these properties contribute toward the state per-pupil costs while still achieving net relief, and in exchange are exempted from local school operating referendum levies.

- Exempt farmland (excluding the house, garage and first acre) from both the local referendum levy and the statewide general fund levy.

- Maintain other remaining school property tax levies on the full local tax base (including businesses, seasonal properties, and farmland) and increase state debt service equalization aid.

In combination with reform of the school finance reliance on the property tax, the governor's recommendation also includes reforms of the property tax classification system and of state aid payment formulas for cities, counties, townships, and individuals. Major features include:

- Reduce property tax classification rates for commercial/industrial, rental, seasonal recreational, and other property types, to reduce disparities in tax rates and reduce the barriers to economic competitiveness and development posed by Minnesota's high tax burden on business and apartment and rental properties.

- Reform the "tiered" classification structure for homestead properties to reduce the impact of market value inflation on property tax rates, and better equalize homeowner tax burdens.

- Create a new state-paid credit for homestead properties to maintain property tax relief for homeowners, with a minimum tax rate requirement to ensure that state payments are targeted efficiently to those with the highest tax rates.

- Assume state funding responsibility for certain court-ordered child protection costs, and for additional court administration costs, in exchange for a reduction in state HACA payments to counties. This will further reduce state-mandated impacts on the local property tax.

- Reform state aid payment formulas to cities and towns, so that they more directly reflect basic costs for municipal services and the local resources available to fund those services, recognizing differences between the large central cities, suburban communities, and Greater Minnesota.

- Increase the maximum homeowner property tax refund to the same level as renters (from $520 to $1,230) to direct more relief to taxpayers with relatively high taxes and low incomes.

The net effect of the governor's recommendations for school finance reforms (including the new general fund levy), property tax classification reforms, and changes in state payment formulas to other local governments is a reduction in property taxes statewide of approximately $800 million per year.

The impact of the governor's recommendations is to significantly reduce the disparities in effective tax rates among various property types that exist under current law. This is especially true for the "local" portion of the property tax.

Sales and Use Tax Reform

The governor's proposal will have the state and local tax system rely less on property and income taxes, and more on the sales tax. The proposal would align sales tax treatment of the service economy (which is largely untaxed) more with the goods economy (which is basically taxed), reduce the rate to six percent, and expand the exemption for capital equipment and business inputs.

In Minnesota, as in many other states, the sales tax has come under growing pressure as a revenue source. The economy has changed as consumption has shifted more from goods toward services. Minnesota's sales tax was first imposed in 1967 on goods only (minus food and clothing), a time when services made up just over 40 percent of total consumption. Since then, services have grown to consume 60 percent of consumer expenditures, yet the sales tax still applies to only a small, select group of services. Minnesota's sales tax is increasingly out of step with the modern economy.

Moreover, the growth of e-commerce and Internet sales - while essential for economic growth - are causing a growing tax loss because sellers from outside Minnesota don't collect and remit the sales and use tax. In the process, Minnesota retailers find themselves at a competitive disadvantage.

Finally, Minnesota has a high state sales tax rate - at 6.5 percent, the third-highest in the country. That high tax rate makes routine purchases for consumers more costly than they otherwise would be, and when imposed on business equipment and supplies, increases the cost of doing business in Minnesota.

The governor's proposal for sales and use tax reform is to preserve and modernize the sales and use tax so that it can continue to serve as a viable alternative to property and income taxes. Citizens told us that while they want overall tax burdens reduced, they would be more willing to trade off the sales tax with the income and property tax, because the sales tax is more within their own control than income and property taxes.

The governor's sales and use tax reform proposal is based on the following principles:

- Taxing consumption is a fair, appropriate way to generate revenue to pay for government services.

- Taxpayers should be treated equally, whether they prefer to consume goods or services.

- The level of taxation should be balanced among the various sectors of the economy.

- Whether or not something is taxable should depend on the product or service being sold, not the business entity or organization that sells the item or service.

- Minnesota's sales and use tax system should be as similar and uniform with other states as possible, so that it is easier for nationwide businesses to collect and remit the state's sales tax.

- "Pyramiding" of sales taxes - taxing the inputs as well as the final product or service - should be avoided.

- The sales and use tax laws should be understandable for taxpayers and as easy for businesses to administer as possible.

- Treat the service economy more like the goods economy, by extending the sales tax base to many business and professional services currently not subject to sales tax, while maintaining exemptions for educational, child care, and health care services.

- Broaden the sales tax base by repealing several exemptions, but maintain current exemptions for essential items such as food, clothing and home heating fuels.

- Reduce the sales tax rate to six percent.

- Expand the definition of exempt capital equipment to include pollution control equipment, and make the capital equipment exemption up front instead of a refund program.

- Expand the definition of exempt business inputs for taxable goods and services.

- Modernize the definition of "telecommunications services" in the sales and use tax statute.

- Repeal the June accelerated sales tax payment requirement.

- Exempt state and local governments from the sales tax.

- Broaden the exemption for purchases by non-profits to include meals, lodging, vehicle rentals and building materials, and exempt sales by non-profits up to the first $25,000 of taxable sales in the calendar year.

- Adopt model legislation for uniform sales tax definitions, filing requirements, and other administrative practices recommended by the National Streamlined Sales Tax initiative. This is a multi-state effort supported by the National Governor's Association, National Conference of State Legislatures, and other organizations, with the goal of achieving nationwide uniformity in administration of the sales tax to promote compliance with state sales and use tax laws by nationwide retailers (whether brick-and-mortar, catalog, or Internet), and preserve state sales and use taxes in the era of electronic commerce.

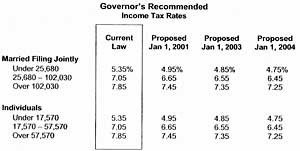

The individual income tax is the largest revenue raiser in the state budget. Despite reductions enacted during the 1999 and 2000 legislative session, Minnesota's rates remain high in comparison to other states (the 10th-highest top rate and the third-highest starting rate). Income tax ubrdens continue to be cited as a competitive disadvantage in attracting and retaining highly-skilled and productive workers to the state. In addition, Minnesota's income tax laws have become increasingly complex in the period since major simplifications were last achieved in the 1980s.

| |

|

|

|

||

- Reduce income tax rates by 0.4 percentage points in all three brackets for calendar years 2001 and 2002, an additional 0.1 point in 2003, and another 0.1 point in 2004 if resources are available.

- Increase the Working Family Credit for taxpayers with one child by $100, and by $200 for those with two or more children in calendar years 2001 and 2002. In 2003 and thereafter, child credits are doubled to $200 and $400, and generation and phase-out rates are increased by 50 percent - achieving an overall doubling of the credit.

- Modify other income tax credits and subtractions: eliminate the dependent care credit beginning in calendar year 2002, and shift the savings to the child care assistance program operated by the Department of Children, Families and Learning; modify the K-12 credit and subtraction to clarify qualifying expenditures and promote better accuracy and compliance.

- Eliminate the Alternative Minimum Tax to simplify tax calculation requirements.

- Reduce and simplify the penalty structure for late filing and payments, so it will be less onerous on taxpayers with short delays, and more effective in preventing lengthy delinquencies.

The governor recommends repeal of the HMO premium tax and the wholesale drug tax, eliminating the scheduled 0.5 percent increase in the provider tax and limiting future reliance on the provider tax by permanently limiting it to 1.5 percent. Under current law, the HMO premium tax would be required to "blink on" and the provider tax revert to a two percent rate. Ongoing funding in the Health Care Access Fund is assured by a dedication of 85 percent of cigarette excise tax proceeds, beginning in FY 2004. This is in addition to recommending transferring selected program expenditures to the general fund.

Motor Vehicle Registration Tax Relief

The governor recommends reductions in the motor vehicle registration tax. Beginning in January 2002, the maximum tax for the first year registration would be $189 and the maximum tax for subsequent registration years would be $89. Beginning in January 2004, the maximum tax for all registration years would be $75. Combined with last year's action, these additional steps will lead to a total reduction of approximately 40 percent in FY 2003. The loss to the Highway User Fund will be replaced by dedicating a specified percentage of the motor vehicle sale tax (MVST) to the highway fund. The recommended MVST dedication is 39 percent in FY 2002 and grows to 61 percent in FY 2005. This will fully reimburse the highway fund for the previous license tab cut, the additional tab cut proposed, and the sales tax rate cut.

Corporate Tax Relief and Reform

The governor is also recommending additional business tax relief, including a corporate income tax rate reduction of 9.4 percent, and 90 percent sales weighting in the apportionment formula (accompanied by base-broadening reforms which partially offset the reduction).

These changes must also be viewed in the context of approximately $300 million in property tax relief that business will receive under the governor's property tax proposal.

Other Tax Changes

The governor is also recommending other tax changes, including:

- A 10 percent reduction in the taconite production tax.

- Reduction and reform in charitable gambling taxes.

- Changes in environmental fees and taxes, and the various funds that support environmental priorities.

- Repeal of several smaller taxes.

- Changes in telecommunication taxes to bring more competition into themarket and broader access to high speed telecommunications, data, and cable services.